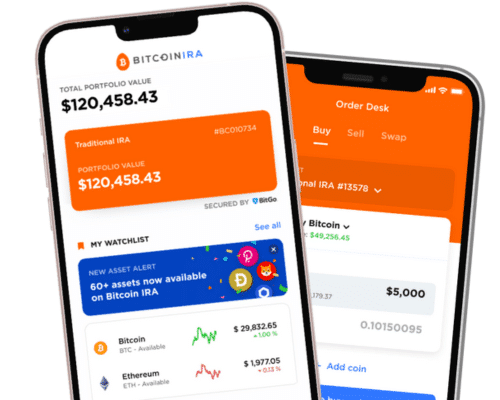

- 24/7 trading

- $250M custody insurance

- Military-grade security

- 80+ cryptocurrencies

- Lots of different fees

- Limited to U.S. investors

You can trade over 80 cryptocurrencies, an industry-leading investment selection from one of the oldest crypto IRA providers.

My Bitcoin IRA review examines the available tokens, account types, research tools, and fees and minimums.

Bitcoin IRA Review: My Verdict

I’ve given them a rating of 9.5 out of 10.

Bitcoin IRA has an ample selection of cryptocurrencies for experienced investors, but its relatively high fees are this company’s most glaring weakness.

| Criteria | Rating (out of 10) |

|---|---|

| Cryptocurrencies Supported | 10 |

| Fees & Minimums | 9.5 |

| Storage & Security | 9.5 |

| Account Setup & Maintenance | 9 |

| Resources & Tools | 9 |

| Reputation & Reviews | 9 |

| Customer Service & Support | 9 |

| Overall Rating | 9.2 |

In this review of BitcoinIRA, I’ve followed CEP’s detailed criteria for evaluating the crypto IRA platform.

About Bitcoin IRA

Bitcoin IRA has been offering tax-advantaged cryptocurrency retirement accounts since 2016.

It was the first company of its kind and now serves more than 200,000 customers across the U.S.

What you can invest In

Trade over 80 cryptocurrencies with direct ownership and 24/7 access.

Choose from multiple account types: Traditional IRA, Roth IRA, SEP IRA, SIMPLE IRA, and even 401(k) rollovers.

Diversify your portfolio with Bitcoin, altcoins, and even physical gold and silver.

Why investors choose BitcoinIRA

Many retirement plans don’t allow crypto. Bitcoin IRA gives you that option, with the same tax benefits as a regular IRA.

Holding crypto in an IRA means you don’t have to report every single trade at tax time.

You can also own physical gold through the platform, stored in secure vaults—something most traditional IRAs don’t allow.

Key considerations

Unlike stock brokers that only offer Bitcoin or Ethereum funds, Bitcoin IRA gives you direct ownership of your tokens, which can also be moved to personal wallets.

However, this platform does not offer traditional investments like stocks or mutual funds—it focuses only on crypto and precious metals.

✅ Bottom line: Bitcoin IRA can be a smart way to add crypto or gold to your retirement savings. It’s best suited for investors who want direct ownership, tax advantages, and extra security, but don’t mind focusing on alternative assets instead of stocks and mutual funds.

Cryptocurrencies Supported

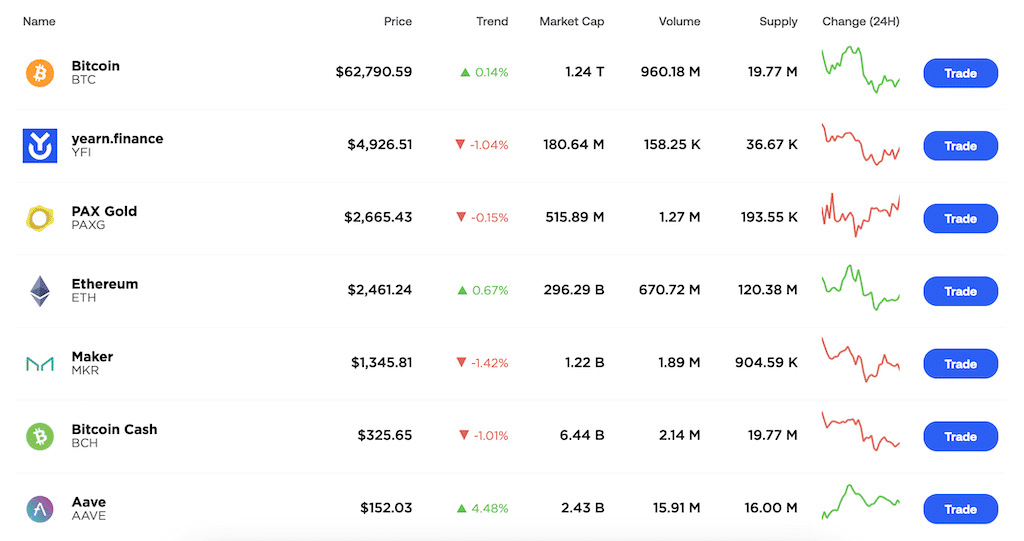

Over 80 cryptocurrencies are available for trading, so you can quickly get exposure to the most liquid altcoins.

Moreover, you can access your security keys and own the actual token instead of crypto futures that reflect the price action but cannot transfer to an external wallet.

A sampling of the offerings include:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- Litecoin (LTC)

- Polygon (MATIC)

- Stellar Lumens (XLM)

- Cardano (ADA)

- Polkadot (DOT)

- Zcash (ZEC)

I appreciate that most of the coins have been trading for several years and are very liquid.

You avoid the “scam coins” and pump-and-dump schemes where only the early investors make money and the token has no long-term growth potential or utility.

Unfortunately, stablecoins are unsupported, although I consider the gold-backed Paxos Gold (PAXG) token a rare exception.

As a worthy alternative, you can hold fiat currency in an FDIC-insured cash account while waiting to reinvest.

Fees & Minimums

The minimum opening deposit is $1,000 plus $10 per trade, which serves as the required initial deposit and represents the platform’s account minimums.

This makes it easy to allocate a small portion of your retirement portfolio without assuming excessive risk.

The low account minimum also makes it possible to start investing without an IRA or 401(k) rollover to satisfy a higher initial threshold.

However, the structure can be expensive for small accounts, so it’s important to understand all fees before investing.

Additionally, larger deposits qualify for a lower setup fee.

| Setup Fee | $0 |

| Trading Fee | 2.00% per transaction |

| Security Fee | 0.08% monthly ($100 minimum) |

| Custodial Fee | 1% annually |

You may also be eligible for a $150 signup bonus to help offset your first year’s fees.

While these fees are comparable to other crypto IRA companies, some competitors have more affordable setup and transaction fees.

However, be sure to compare the supported cryptocurrencies and account insurance coverage limits too.

The world's first and most trusted crypto IRA platform that lets you self-trade cryptocurrency.

Storage & Security

Your retirement savings need strong protection—especially when they’re in cryptocurrency. Bitcoin IRA partners with Digital Trust, a Nevada-based self-directed IRA custodian, to handle record keeping and tax documents.

This custodian also supports precious metals IRAs.

How your crypto is stored

Your coins are kept in 100% offline “cold storage” wallets. This makes it nearly impossible for hackers to access your assets.

All holdings are segregated, meaning your coins are stored separately from other investors.

No coins remain on the Bitcoin IRA platform—they go straight into cold storage.

Security features you can count on

Neither you nor Bitcoin IRA has access to your private keys, adding another layer of protection.

The platform uses multi-signature technology, meaning multiple security keys are required for any transaction.

Most customers store assets with BitGo, a trusted provider that also works with top financial institutions.

Insurance & protection

Your digital assets are insured for up to $250 million against theft, loss, or misuse.

This insurance helps safeguard your nest egg, whether you plan to hold for the short term or long term.

Extra safety checks

When you make a withdrawal, you’ll go through a video call identity check to confirm it’s really you.

The platform also sends a micro-deposit test to your wallet before completing a transfer. This prevents errors since crypto transactions are irreversible.

✅ Bottom line: Bitcoin IRA takes security seriously. With cold storage, insurance, and extra identity checks, your retirement investments in crypto are designed to stay safe and protected.

Account Setup & Maintenance

You can easily open your cryptocurrency IRA with hands-on help:

- Create a BitcoinIRA account: You can join online or by phone. This initial step verifies you are at least 18 years old, live in the United States, have a photo ID, and a US bank account.

- Fund your account: An IRA specialist helps fund your account with new money from a linked bank account or by performing a 401(k) to crypto IRA rollover. The funding process usually takes three to five business days.

- Start trading cryptocurrency: Your deposits are tradeable 24/7 from your personalizable dashboard. The platform lets you buy, sell, or trade over 60 cryptocurrencies and view your tax forms.

I find the platform easy to use, and the layout is similar to that of many cryptocurrency exchanges.

Being able to start the process online is convenient too and makes sense for digital asset investing.

Open a free account in just 3 minutes

Resources & Tools

You can read several articles or watch videos to learn more about the various Bitcoin IRA features and how cryptocurrency IRAs work.

Some videos cover the latest cryptocurrency investment trends, such as the Bitcoin halving or media interviews.

You can track real-time prices, access advanced charts, and create custom price alerts within the web platform or iOS and Android mobile app.

These resources and tools are similar to competitors, and the learning curve is minimal if you’re an experienced crypto investor.

You will need to rely on third-party research tools to analyze potential investments and manage risk.

Reputation & Reviews

Most Bitcoin IRA reviews are positive, mentioning excellent customer service and one-on-one attention, regardless of your balance amount.

There are over 5,000 five-star ratings across various consumer platforms such as Trustpilot, Google Play, Apple App Store, and the Better Business Bureau.

Unfortunately, the most common complaint is the high setup and ongoing fees that erode your potential investment returns.

Additionally, several recent reviews state the mobile app is somewhat difficult to navigate and trades don’t always execute instantly despite the 24/7 trading window.

Bitcoin IRA has had Better Business Bureau (BBB) accreditation since 2020 with an A+ BBB rating.

This metric indicates the company quickly responds to customer inquiries and has transparent business practices.

Further, this crypto IRA company is a Forbes Finance Council member. This cohort consists of respected finance leaders with depth and diversity of experience.

Customer Service & Support

Phone support is available Monday to Friday from 6 a.m. to 5 p.m. Pacific. You can also schedule a free 15-minute consultation or send an email and receive a response back within 48 hours.

Various customer reviews suggest the representatives are very knowledgeable with the IRA setup process and answer basic cryptocurrency questions.

Like any IRA provider, you won’t receive personalized advice and you’re responsible for investment selection and position sizing.

Digging deeper, I suggest reading the risk disclosures before investing to gain a better understanding of your broker relationship.

Bitcoin IRA Alternatives

Another Bitcoin IRA company may have more agreeable fees and a user-friendly platform, although the supported cryptocurrencies and minimum investment can be more restricting.

|

Our Rating:

4.8

|

Our Rating:

4.5

|

Our Rating:

4.2

|

|

Trading Fee:

$300

|

Trading Fee:

1.00% transaction fee

|

Trading Fee:

.14% - .5%

|

BitIRA

BitIRA has approximately 15 cryptocurrency options which is notably fewer than BitcoinIRA, as the platform focuses on the most liquid tokens.

The minimum investment is $5,000 and has fixed transaction and account fees which may impact smaller accounts. The average annual fee is between $300 and $1,000.

Get a free Ledger Nano from BitIRA

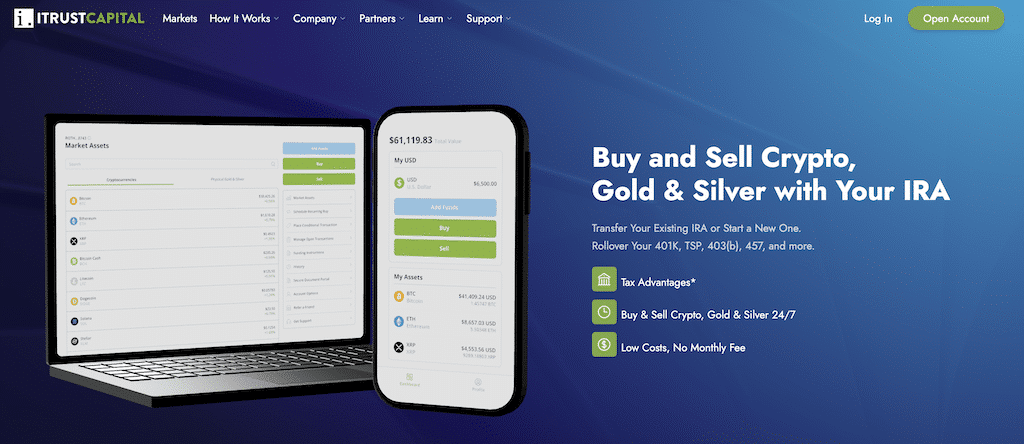

iTrustCapital

Consider iTrustCapital to invest in crypto, gold, and silver with a $1,000 minimum investment. Interestingly, the fees are lower such as a 1% transaction fee, no setup fees, or monthly fees.

However, there are fewer supported cryptocurrencies with approximately 40 tokens.

Open an account with iTrustCapital today

BlockTrustIRA

BlockTrustIRA launched in 2023 with the same leadership team as Genesis Gold Group, a gold IRA provider focused on ethical business practices and low fees.

Open an account with BlockTrustIRA

Is Bitcoin IRA a legitimate company?

BitcoinIRA is one of the best cryptocurrency IRAs as you have more than 60 investment options that make it easy to make short-term tax-advantaged trades 24/7.

The hands-on support by phone, along with web and mobile platforms, make it easy to navigate.

Finally, the $250 million custody insurance coverage and multi-layer security provide peace of mind, but the various account service fees are expensive in several situations.

Sign-up today and earn a $150 reward.

FAQs

Can I withdraw Bitcoin from BitcoinIRA?

You can request a Bitcoin distribution to your private wallet instead of converting it to fiat currency.

However, this event is still subject to traditional and Roth IRA distribution rules and tax treatment.

Is Bitcoin IRA FDIC insured?

Cash balances are FDIC-insured up to $250,000.

However, cryptocurrency holdings are eligible for up to $250 million in custody insurance independent from FDIC Insurance and similar government insurance programs, such as SIPC, for investment securities like stocks and funds.

Who owns Bitcoin IRA?

Camilo Concha, Johannes Haze, and Chris Kline are the BitcoinIRA co-founders. Each currently maintains a senior leadership role.

The world's first and most trusted crypto IRA platform that lets you self-trade cryptocurrency.

Bitcoin IRA

Bitcoin IRA is the 1st and most trusted crypto IRA platform that lets you self-trade cryptocurrency in a self-directed IRA.

Product Brand: Bitcoin IRA

4.6