|

Our Rating:

4.9

|

Our Rating:

4.8

|

Our Rating:

4.7

|

|

Promotion:

Zero fees for up to 10 years (depending on the investment amount)

|

Promotion:

Up to $10,000 or more in free silver (with qualifying purchase)

|

Promotion:

No current promotions

|

Our guide helps readers identify the best gold IRA companies based on expert evaluation criteria such as fees, regulations, and account options.

We bring years of experience in finance and economics to add context to help you understand how investing in gold works.

All of the gold companies we evaluated offer something different to investors. Augusta Precious Metals was our overall top pick for providing good customer support, product offerings, and educational materials for new investors.

Some companies we evaluated are for more advanced investors with larger account balances. Others are suited for new investors who want to learn more about how gold can help hedge against economic downturns.

Keep reading to learn more about the criteria we used to evaluate each gold company on our list and how you can find the right gold company to invest in.

Top Gold IRA Companies of 2025

- Augusta Precious Metals – Best overall

- Goldco – Most 5-star customer reviews

- Advantage Gold – Best customer service

- Birch Gold Group – Best for 1st-time buyers

- Noble Gold Investments – Best pricing

- GoldenCrest Metals – Lowest fees

- Priority Gold – Best customer experience

- American Hartford Gold – Best promotions

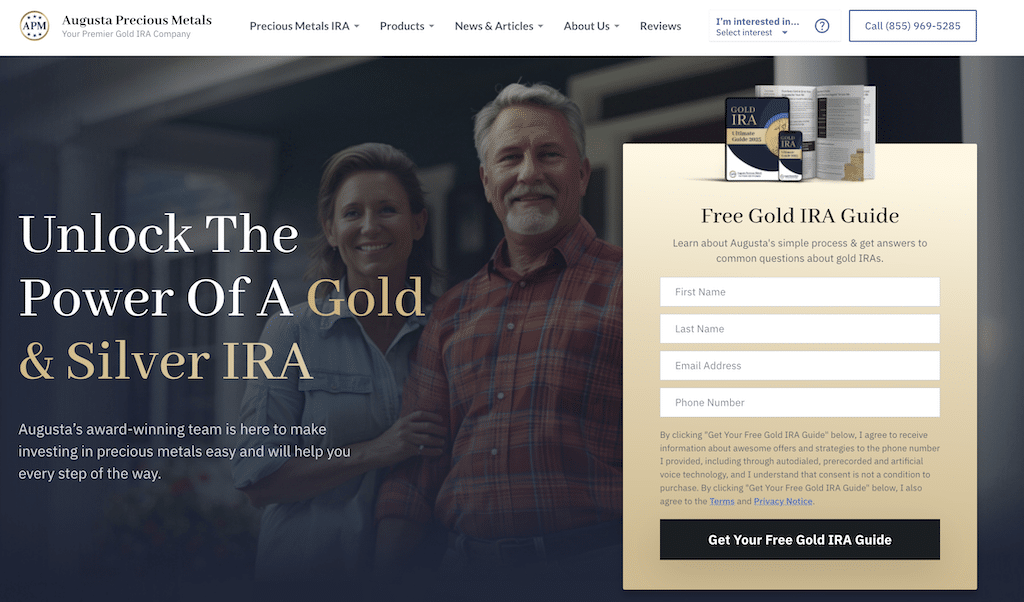

1. Augusta Precious Metals – Best overall

Editors’ opinion

Augusta Precious Metals provides the best education for customers interested in learning how to invest in gold. It scored 85.7%.

Best for Suited For

Investors who want to learn more about investing in gold and precious metals.

BBB Rating

Augusta Precious Metals has an A+ rating from the BBB. It has earned 4.94 stars from 104 customer reviews. Notably, the company has not had any complaints during the last year.

Fees & Minimums

All of Augusta Precious Metals’ IRAs are self-directed. There are no fees to manage a gold IRA, but there is a $50,000 minimum order requirement to make IRA purchases. There is an account set-up fee of $50, an annual custodian fee of $100, and a depository storage fee of $100.

Augusta Precious Metals does not provide prices for individual coins or bars. You’ll need to call and speak with a representative for more detailed pricing information.

Pros & Cons

Lifetime customer support

A+ BBB rating

One-on-one web conference

1,000’s of 5-star customer reviews

Must order by phone

High minimum investment

Based in Beverly Hills, Augusta Precious Metals has been in business since 2012. It primarily offers gold and silver IRAs and assists investors who wish to rollover their savings from an existing retirement account.

The company provides great educational support to help its clients understand the value of investing in precious metals. Augusta Precious Metals has a strong reputation for customer service and is one of only two companies we reviewed that had no recent complaints.

Company Highlights

- Education-first mission

- Simple process to rollover existing retirement savings

- Award-winning customer service

- No hidden fees

Why we like Augusta Precious Metals

- Strong emphasis on investor education

- Good buy back policy

- No BBB complaints

2. Goldco – Most 5-star customer reviews

Editors’ opinion

Goldco is the 2nd pick, scoring 90% out of 100. The company offers a large variety of gold and precious metal assets. It supports rollovers from different accounts, including 401(k)s, 403(b)s, IRAs, thrift savings plans, and savings accounts.

Best suited for

Investors looking to roll over a sizable portfolio from an existing retirement plan. Investors must deposit at least $25,000 before they can begin investing in a gold IRA.

BBB Rating

Goldco has an A+ rating from the BBB. It has earned 4.81 stars from 1,041 customer reviews.

Fees & Minimums

Goldco has no minimums for any new customers that want to buy precious metals with cash or their retirement account. There is a one-time account set-up fee of $50, and the custodian fee ranges from $200 to $250, depending on which custodian you choose.

Pros & Cons

A+ BBB rating

Over 6,000+ 5 star reviews

Highest buy back guarantee

No minimums

Only can invest within U.S.

No online purchase available

Goldco is a top company offering gold IRAs and rollovers for several different retirement plans. It takes an education-first approach to help investors understand the impact precious metal investing can have on their portfolios and the overall economy.

When you invest with Goldco, you can store your gold with one of Goldco’s custodians or send it directly to you. Its account offerings allow you to rollover your 401(k), 403(b) thrift savings plan, or IRA while providing the same tax benefits.

The company has been in business since 2006 and has a reputable customer service record. Compared to other companies, Goldco has a smaller selection of precious metals to choose from and higher deposit minimums.

Company Highlights

- Excellent customer service

- Incentive to invest more

- Long-standing reputation as a reputable gold dealer

- Top-notch educational resources

Why we like Goldco

- Silver bonus encourages investing

- Reputable customer service

- High BBB rating

3. Advantage Gold – Best customer service

Editors’ opinion

Advantage Gold’s IRA gives investors a range of options, making it good for first-time gold investors. It scored 88.6%.

Best for Suited For

First-time investors just starting to invest in precious metals.

BBB Rating

Advantage Gold has an A+ rating from the BBB. It has earned 4.88 stars from 74 customer reviews. It has not had any customer complaints in the last year.

Fees & Minimums

Advantage Gold charges a $50 one-time account set-up fee. Annually, investors can expect to pay between $80 to $100 for a custodian fee and $95 to $250 for a storage fee, depending on where you decide to store your gold.

Advantage Gold also offers a first-year fee waiver for investments over $50,000. There is a $10,000 minimum for cash purchases and a $25,000 deposit minimum for IRAs.

Pros & Cons

A+ BBB rating

U.S. Mint-listed dealer

3,000+ 5-star reviews

Excellent customer service

Limited to U.S. investors

No international storage

Advantage Gold is a top-rated gold dealer offering a competitive gold IRA well-suited for first-time investors. Investors can work with an account manager to help them set up an account.

Its fees are competitive, and Advantage Gold gives new investors different options for storing their gold. Advantage Gold’s team of professional experts makes the company a good resource for investors who want to learn more about investing in gold.

Company Highlights

- Investors can choose where they want to deposit their gold

- Large accounts can receive a fee waiver for the first year

- Strong industry ratings and customer reviews

- First-time investors will work with a trained professional to open an account

Why we like Advantage Gold

- Good reputation

- Flexible fee structure

- Expert-level support

Our experts specialize in converting your existing IRA or eligible 401(K) into gold or other precious metals.

4. Birch Gold Group – Best for 1st-time buyers

Editors’ opinion

Birch Gold Group has the best customer service, answering questions for new investors to help them feel confident in their investment decisions. It scored 85.7% overall.

Best for Suited For

New investors who need help navigating how to add gold to their investment portfolio.

BBB Rating

Birch Gold has an A+ rating from the BBB. It has earned 4.31 stars from 102 customer reviews.

Fees & Minimums

Birch Gold Group requires an initial minimum purchase of $10,000. There are no minimum requirements to maintain an account.

Opening an account comes with a one-time $50 setup fee. After that, account holders are charged $200 annually to cover storage, insurance, and account management. Account fees are the same for all accounts, regardless of size.

This fee structure could benefit investors with a larger balance who want to take advantage of low fees.

Pros & Cons

A+ BBB rating

Low minimum investment

30,000+ customer reviews

Commitment to customer education

No online purchases

Limited to U.S. investors

Birch Gold Group stands out for its customer service and rollover options. Offering gold IRAs since 2002, Birch Gold Group is one of the oldest companies in the business. Its customer service team is very knowledgeable about the impact gold can have on your portfolio.

You can rollover your retirement savings from several IRAs, including a traditional IRA, Roth IRA, SEP IRA, or SIMPLE IRA. You can also rollover your savings from an employer-sponsored retirement account like a 401(k), 403(b), or 457(b).

Company Highlights

- Strong customer service record

- Flat fee structure

- Easy rollover process across several employer-sponsored accounts

- Offers two decades of expertise

Why we like Birch Gold Group

- Easy rollover process

- Low deposit requirement

- Exceptional customer service record

As a leading national dealer of precious metals, Birch Gold Group helps Americans diversify their savings with physical gold and silver.

5. Noble Gold Investments – Best pricing

Editors’ opinion

Noble Gold Investments offers the most competitive costs for someone just starting a gold IRA. They earned an overall score of 90%.

Best for Suited For

Good for someone who wants to start investing in precious metals but doesn’t want to spend an arm and a leg doing so.

BBB Rating

Goldco has an A+ rating from the BBB. It has earned 4.98 stars from 186 customer reviews.

Fees & Minimums

Investors will need to make a $20,000 minimum investment to open a gold IRA with Noble Gold Investments. There is an annual $80 fee to maintain the account, and storing your gold with one of Noble Gold Investments depositories will come with an additional yearly fee of $100 to $150, depending on how your gold is stored.

Noble Gold Investments does not provide pricing on specific purchases. You’ll need to contact a customer service representative for more information.

Pros & Cons

Lowest fees in the industry

Best buy back program

Concierge service

Excellent customer support

No international storage

Limited to U.S. investors

Noble Gold Investments offers competitive pricing for investors looking to set up a gold IRA. They charge an $80 annual fee and a separate depository storage fee lower than most of their competitors.

Noble Gold Investments offer retirement rollovers, but where they stand out is in their emergency packs. These are designed to allow investors to keep gold on hand during times of emergency.

Company Highlights

- Makes it easy to liquidate gold

- Simple process to open an account

- Low annual fee compared to other gold companies

- Industry newcomer – in business since 2016

Why we like Noble Gold Investments

- Low fees and competitive pricing

- Ability to liquidate gold when you need it

- Strong BBB rating and good customer reviews

Noble Gold Investments is a leading provider of IRA approved precious metal investments.

6. GoldenCrest Metals – Lowest fees

Editors’ opinion

GoldenCrest Metals has high customer service ratings from investors who appreciate receiving personal support. It scored 80% out of 100.

Best for Suited For

Investors seeking guided support opening a gold IRA.

BBB Rating

GoldenCrest currently has an A- rating from the BBB. This is rating is due to the company being newer.

Fees & Minimums

GoldenCrest Metals doesn’t charge any setup or wire transfer fees for new customers. There is an annual custodian admin fee of $199 and storage fees of .005% of your total account value.

GoldenCrest Metals requires a $10,000 minimum investment for both IRA transfers and cash purchases.

Pros & Cons

Lowest price guarantee

Zero buyback fees

Transparent pricing

5-star reviews on Trustpilot

Newer company

Only available to U.S. investors

GoldenCrest Metals is a precious metals dealer that helps Americans safeguard their wealth by investing gold and silver.

GoldenCrest Metals was founded in 2023 and is headquartered in Calabasas, California, serving customers nationwide.

Company Highlights

- Over two decades of experience in the precious metals industry.

- Lowest price guarantee, zero buyback fees, and fully transparent pricing.

- A- BBB Rating & 5-star reviews on BBB, TrustPilot, & Google.

- Endorsed by trusted national voices including Gregg Jarrett, Joe Pags, Kevin Harrington, and Michael Savage.

Why we like GoldenCrest Metals

- Commitment to transparency

- Over 20 years of industry experience

- High level of customer support

6. Priority Gold – Best for customer experience

Editors’ opinion

Priority Gold puts customers first to give investors a high-quality experience. It scored 80% out of 100.

Best for Suited For

Someone looking for extra support and would benefit from a great customer experience.

BBB Rating

Priority Gold has an A+ rating from the BBB. It has earned 4.27 stars from 11 customer reviews.

Fees & Minimums

Priority Gold charges a one-time $50 setup fee. There’s an annual service fee of $125 and an annual storage fee between $100 to $175.

Priority Gold requires a minimum purchase price of $10,000 and $20,000 to set up an IRA. The company will waive first-year fees for investors who deposit at least $50,000.

Pros & Cons

A+ BBB rating

Transparent pricing

Free shipping

Excellent customer service

Newer company

No online purchases available

Priority Gold is a reputable precious metals dealer with a strong customer service record. It offers competitive pricing and covers first-year fees for qualifying clients. While the company strives to be user-friendly, it might be challenging to discern which coins are IRA-eligible.

Company Highlights

- Good customer service record

- First-year fee coverage for qualifying investors

- Competitive account fees

- More than two decades of experience

Why we like Priority Gold

- Length of time in the industry

- Competitive pricing

- Customer support

We aim to provide unparalleled knowledge and expert guidance on precious metals markets and products.

7. American Hartford Gold – Best Promotions

Editors’ opinion

American Hartford Gold helps investors get more out of their investments. It scored 65.7%

Best for Suited For

Experienced investors who want to take advantage of the company’s offerings.

BBB Rating

American Hartford Gold has an A+ rating from the BBB. It has earned 4.95 stars from 526 customer reviews. American Hartford Gold had the most complaints in the last year of the companies we reviewed.

Fees & Minimums

American Hartford Gold requires an initial purchase of $10,000 to open a gold IRA and a $5,000 purchase for cash accounts. Its fees are on the higher end compared to other gold companies.

There’s an initial fee of $230 to apply for and open an account. Afterward, investors will pay $200 annually for custodian services, storage, and insurance.

The company does not provide transparent pricing on its website. You’ll need to call and speak with a customer service representative to learn more.

Pros & Cons

A+ BBB rating

Price match guarantee

Buy back commitment

1,000’s 5-star reviews

No online purchases

Limited to U.S. investors

Established in 2015, American Hartford Gold is a respected precious metals dealer in Los Angeles. The company is well-suited for investors looking to diversify their retirement accounts with precious metals, especially those with larger deposits, as American Hartford Gold will waive fees for qualifying investors.

American Hartford Gold provides good customer support but has had the most complaints from any of the companies we reviewed.

Company Highlights

- Low minimum investment requirement of $5,000 for cash accounts and $10,000 for gold IRAs

- Strong buyback commitment with no fees

- Reputable dealer offering a wide range of gold, silver, platinum, and palladium coins and bars, available for both direct purchase and inclusion in a gold IRA

- Good reputation

Why we like American Hartford Gold

- Ability to liquidate your gold when you need it

- Low IRA minimum

- Opportunity to waive fees

American Hartford Gold is proud to help individuals and families protect their wealth by diversifying with precious metals.

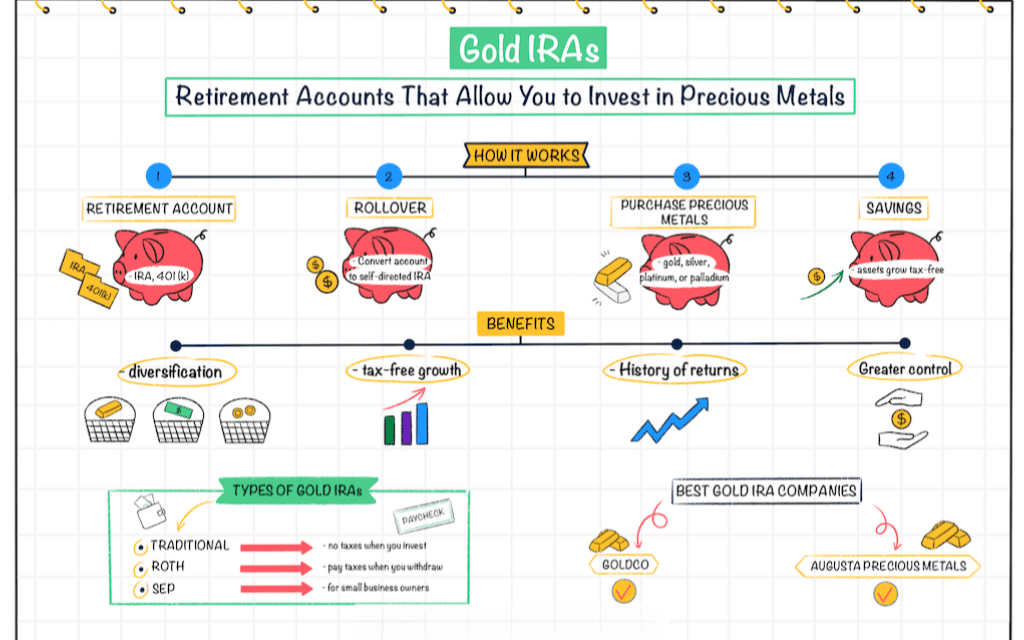

Gold IRA Investors Guide

Gold can be a good option to protect your savings against inflation.

A gold IRA works similarly to traditional IRAs, but instead of holding stocks or bonds, you invest in physical gold assets such as coins and bullion, with specific processes for contributions and storage.

Here is everything you need to know about gold IRAs, how they work, and things you’ll want to consider when choosing a gold company to invest with.

What is a Gold IRA—and How Does It Work?

A gold IRA is a special type of retirement account that lets you invest in physical gold and other precious metals, like silver or platinum.

Instead of holding stocks, bonds, or mutual funds, you can add gold coins or bars to your retirement savings.

How a Gold IRA Works

Here’s how to get started with a gold IRA:

- Open an account with a company that specializes in gold IRAs

- Rollover funds from your current IRA, 401(k), or other retirement plan

- The company helps you fill out the paperwork to avoid tax penalties

- Once your account is funded, you choose the gold or other metals you want to invest in

- Your gold is stored in a secure, IRS-approved depository

You’ll get official documentation showing what’s in your account and confirming it meets IRS rules.

Costs to Expect

Gold IRAs do come with a few extra costs:

- Custodian fees – to manage your account

- Storage fees – to keep your metals safe in a secure facility

Unlike a traditional IRA or Roth IRA, you can’t store the gold at home—it must be kept in an approved vault.

Taking Distributions

At age 59½, you can start taking money out of your gold IRA. You can:

- Sell the gold for cash, or

- Take physical possession of your gold

Understanding the Risks of a Gold IRA

While gold is often seen as a safe long-term investment, it’s important to know the risks—especially when using it in a retirement account like a gold IRA.

Gold prices can fluctuate

Gold usually holds its value, but the price can go up and down. If you need to sell during a market dip, you could lose money—even if the gold itself hasn’t changed.

Fees can add up

Gold IRAs come with storage and custodian fees. These extra costs can chip away at your investment, especially if gold prices aren’t rising.

Selling gold isn’t always easy

Gold is a physical asset, and that means it’s sometimes harder to sell than stocks or mutual funds.

When it’s time to take money out, you may not find a buyer right away—especially in a slow market.

You can’t keep the gold yourself

The IRS doesn’t allow you to store your gold at home. Instead, it must be held in a secure, IRS-approved depository. That means you’re relying on third parties—like custodians and storage facilities—to handle your gold properly.

This adds security and compliance risks, especially if one of those companies fails to follow the rules.

Gold doesn’t generate income

Unlike stocks or bonds, gold doesn’t pay interest or dividends. That means your gold IRA won’t generate income in retirement.

You’re counting solely on the value of the metal when it’s time to sell.

Bottom line: A gold IRA can be a useful part of a diversified retirement strategy, but it’s not without downsides. Be sure to weigh the costs, risks, and potential rewards—and talk to a financial advisor to see if it fits your goals.

Why a Gold IRA Might be a Good Idea

If you’re approaching retirement and worried about inflation or market swings, a gold IRA could be a smart addition to your financial plan.

Protect your savings from inflation

As prices rise, the value of your money can shrink. Gold is known for holding its value, which makes it a popular way to protect your purchasing power—especially during times of economic uncertainty.

Add balance to your portfolio

Many retirement accounts are heavily invested in stocks or real estate. That can be risky if the market takes a hit—like during the 2008 financial crisis.

A gold IRA helps you diversify your investments by adding an asset that’s often more stable during downturns.

Potential tax benefits

Like traditional IRAs, gold IRAs offer tax-deferred growth.

That means:

- If your gold increases in value, you won’t pay taxes on the gains until you withdraw.

- This can help your money grow faster over time and reduce your tax bill in the short term.

A note on risk: Gold isn’t risk-free—but it can be a useful part of a balanced retirement strategy, especially if you’re looking to reduce your exposure to stocks and protect your savings long-term.

How to Choose the Right Gold IRA Company

If you’re thinking about investing in gold for retirement, choosing the right gold IRA company is an important first step.

Here’s what to look for:

1. Check the Company’s Reputation

Start by doing a little homework:

- How long has the company been in business?

- Who runs the company?

- What do customer reviews say?

Look for a provider with a solid track record, transparent practices, and a reputation for good customer service.

2. Understand the fees

Gold IRAs come with several types of fees, including:

- Account setup fees

- Custodian fees

- Storage fees

- Markups on gold and silver products

Fees vary from company to company. Be sure to compare costs so you know what you’re paying for—and avoid surprises down the line.

3. Compare products and storage options

Not all gold IRA companies offer the same:

- Types of precious metals (gold, silver, platinum, etc.)

- Storage choices like segregated or non-segregated vaults

- Partnered custodians and depositories

Choose a company that fits your investment goals and security preferences.

4. Review their buyback policy

If you ever need to sell your gold, it helps to have a smooth exit plan. Some companies offer a guaranteed buyback program with no questions asked. Others may be more limited.

While you’re not required to sell your metals back to the original dealer, doing so may be faster and more cost-effective—especially in an emergency.

Final Tip: Ask Questions

A good gold IRA company will gladly walk you through everything—from setup to storage to selling.

Don’t hesitate to ask about fees, policies, or anything else that helps you feel more confident in your decision.

Key Takeaways

Picking the right company to manage your retirement savings is a big decision—and not all gold dealers put your interests first.

Start by learning about the company’s mission and values. This can give you insight into how they treat customers and how they price their services.

Two top-rated companies include:

- Augusta Precious Metals – known for low fees, reasonable minimums, and strong customer support

- Goldco – backed by nearly 20 years of experience and trusted by many retirees looking to diversify with gold

Before opening a gold IRA, take time to do your research. Learn the pros and cons of gold investing, and get familiar with how gold IRAs work.

Most companies offer free guides and have dedicated support teams who can answer your questions and help you decide if a gold IRA fits your retirement goals.

FAQs

Are gold IRAs a good investment?

Gold IRAs can be a good option if you want to diversify your retirement savings or protect against inflation.

Is gold and silver a good investment for retirement?

Gold and silver can help protect your savings from inflation, but they don’t generate income like stocks or bonds.

Where are my precious metals stored?

Precious metals in a gold IRA is stored in secure, IRS-approved depositories managed by a custodian.

Can I store gold from my IRA at home?

No, IRS rules require that gold in a gold IRA be stored in an approved facility—not at home.

How long does it take to rollover my account to gold?

The rollover process usually takes a few days to a couple of weeks. It must be completed within 60 days to avoid penalties.

CEP DC’s Best Gold IRA Companies: 2025 Top Picks

- Augusta Precious Metals – Best overall

- Goldco – Most 5-star customer reviews

- Advantage Gold – Best customer service

- Birch Gold Group – Best for first-time buyers

- Noble Gold Investments – Best pricing

- GoldenCrest Metals – Lowest fees

- Priority Gold – Best customer experience

- American Hartford Gold – Best promotions

Our methodology

We looked at each company’s fee structure, how long they’ve been in business, and customer reviews. We also looked at qualitative criteria, including leadership, educational resources, and ease of access. Each criteria was given a score and graded out of 100. These scores allow us to compare companies across different features to generate a list of the best gold companies to invest with.