- A+ BBB rating

- Over 6,000+ 5 star reviews

- Highest buy back guarantee

- Excellent customer service

- Only can invest within U.S.

- No online purchase available

I will help you determine if Goldco the right choice to provide you with precious metals for either a precious metals IRA or for direct purchase.

Goldco can be an excellent choice for either investment. However, our major concern is the lack of transparency in markup charges over bullion cost (you must contact the company directly for this information on each purchase).

Learn more in this Goldco review.

Goldco Review: My Verdict

Goldco is a well-regarded (by consumers) precious metals dealer, giving customers the choice to either take direct custody of their metal investments, or to set them up in a gold or silver IRA account.

What sets Goldco apart from other providers is its strong reputation for reliability, unique offerings, and a high level of customer trust.

I’ve given them a rating of 9.5 out of 10.

The company operates in a manner like other precious metals dealers, though you must call directly to obtain specific pricing information on the metals you wish to purchase.

In our Goldco review we’ve considered the following criteria in evaluating this company:

| Category | Rating (out of 10) |

|---|---|

| Product & Service Offerings | 9 |

| Fees & Minimums | 8 |

| Guarantees | 9.5 |

| Customer Experience | 9.5 |

| Storage & Security | 10 |

| Account Setup & Maintenance | 9 |

| Reputation & Reviews | 10 |

| Overall Rating | 9.5 |

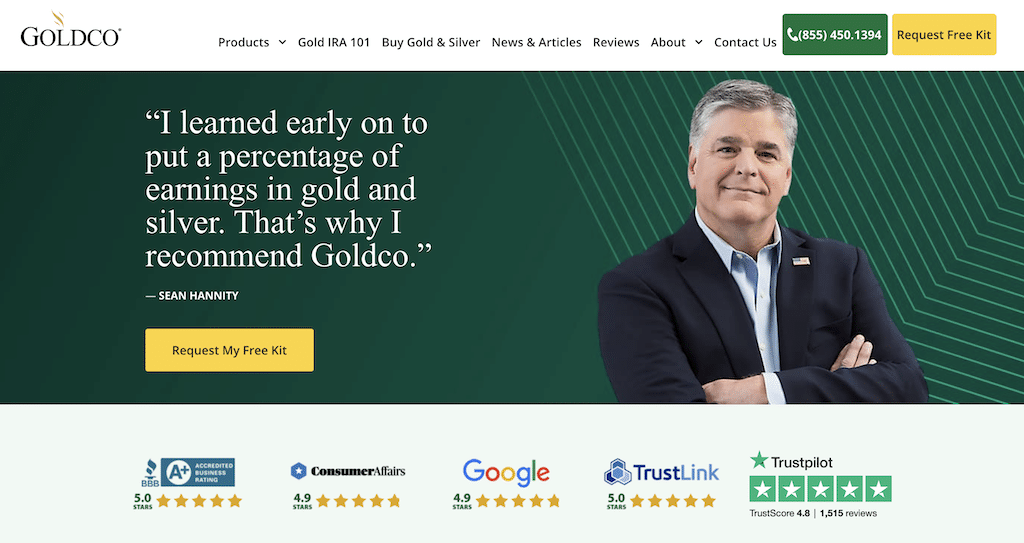

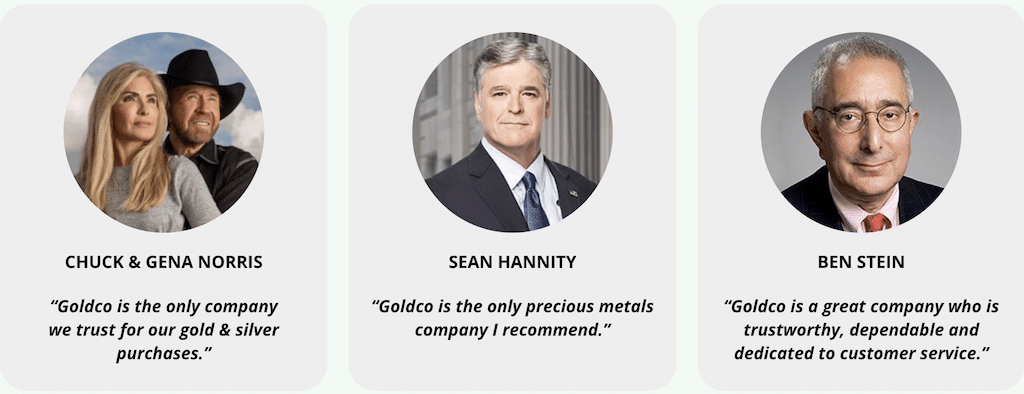

Goldco consistently receives high ratings and positive reviews, reflecting strong customer satisfaction and reinforcing why so many retirees trust Goldco, especially given its celebrity endorsements and high BBB ratings.

In this review of Goldco, I’ve followed CEP’s findings and can confidently recommend Goldco based on its reputation, customer satisfaction, and trustworthy service.

About Goldco Precious Metals

Founded in 2011 and based in Calabasas, California, Goldco helps Americans protect their retirement savings with precious metals like gold and silver.

Their mission is simple: give people more ways to secure their financial future.

Many retirees and pre-retirees discover Goldco while researching safe, reliable ways to invest in gold. The company stands out for its easy-to-understand educational materials on gold IRAs and personal finance.

Goldco has earned a strong reputation for its excellent customer service and one-on-one support. Whether you’re opening a gold IRA or buying gold and silver directly, Goldco guides you every step of the way.

Since opening, Goldco has reportedly helped clients place over $3 billion in gold and silver.

The company holds top ratings from Trustpilot and the Better Business Bureau. It’s also endorsed by well-known figures like Chuck Norris, Sean Hannity, and Ben Stein.

From the founder

I believe that there is always a good time to invest in gold and silver — when markets are down, precious metals tend to rise in value.

When markets are more stable, precious metals continue to steadily grow in value. (source)

Product & Service Offerings

Goldco’s primary products are its precious metals IRA including specialized gold IRAs and silver IRAs—and direct sales of gold and silver to customers.

As a provider of precious metal investments, Goldco offers a range of precious metal options, allowing customers to diversify their portfolios with gold, silver, and other precious metals.

Goldco IRA

Note:

Goldco does not act as a trustee for IRA accounts the way investment brokers and banks do. Instead, they are a precious metals dealer providing a source of metals for IRA accounts held by other trustees. See Storage & Security below.

Opening a gold IRA with Goldco gives you an easy way to diversify your retirement savings with physical gold and silver.

These accounts use IRS-approved metals and secure storage options, and Goldco’s experts guide you through every step.

A Goldco precious metals IRA lets you invest in assets that don’t move with the stock market. That means your savings can be better protected during economic downturns.

You can fund your gold or silver IRA by rolling over money from an existing 401(k), 403(b), Thrift Savings Plan, or IRA. This rollover process is straightforward and helps you move funds without penalties when done correctly.

You’ll have the option to open either a gold IRA or a silver IRA, and each can be set up as a traditional IRA or Roth IRA, depending on your tax preferences.

Goldco makes sure all metals meet IRS rules, so your account stays fully compliant. Only IRA-eligible coins and bars are available, helping you choose the right metals for your retirement goals.

You can invest in gold, silver, platinum, or palladium. All metals must be in bullion form—either coins or bars. Gold must be at least 99.5% pure, and silver must be 99.9% pure. (The American Gold Eagle is an exception and allowed at 91.67% purity.)

Choosing the right mix of metals is an important part of building a secure and well-balanced retirement portfolio.

Goldco Direct

With Goldco Direct, you can buy gold and other precious metals without opening a retirement account.

This gives you more flexibility and lets you have physical gold or silver delivered straight to your home—with no IRS restrictions.

Note

If you send payment by check, Goldco will send you a FedEx shipping label enabling you to avoid shipping costs should you decide to take possession of the metals purchased.

Simple buying process

Getting started is easy:

- Open an account by agreeing to Goldco’s terms.

- Fund your account by sending a check or wiring funds to Goldco’s Los Angeles office.

- Choose your metals—then place your order for gold or silver.

There’s usually no minimum investment, which makes Goldco Direct a good choice for first-time buyers or those testing the waters.

Delivery and storage options

- You can choose to:

- Have your metals shipped directly to your home

- – Or store them securely in a professional depository

(For IRAs, metals go to an IRS-approved depository. For direct purchases, home delivery is an option.)

Available gold products

Goldco offers several trusted gold investments, including:

- American Eagle gold bullion coins (.10 oz to 1 oz sizes)

- Canadian Gold Maple Leaf coins (.10 oz to 1 oz sizes)

- Commemorative gold coins from the U.S., U.K., Canada, Australia, New Zealand, and the Netherlands

- Gold bars in a range of sizes

What Goldco doesn’t offer

Goldco’s selection is more limited than some competitors. They do not offer:

- South African Krugerrands

- – Mexican Gold Pesos

- – British Sovereigns

- – Numismatic coins (rare collectible coins valued more for rarity than metal content)

If you’re focused on bullion-based investing—not collectibles—Goldco Direct may be a strong fit.

Fees & Minimums

Whether you open a precious metals IRA or simply an account to purchase metals directly from Goldco, you should expect to incur the following Goldco charges:

| Setup fee for IRA | $50 (one-time, only for IRA account set-up, not cash purchases) |

| Wire transfer fee | $30 |

| Custodian administration fee | $125 annually |

| Storage fees | $100 for non-segregated or $150 for segregated per year |

The big difference with Goldco’s fee structure is the transparency and predictability of their annual fees and storage costs, which sets them apart from many competitors who may have hidden or variable charges.

Goldco Promotions

Though it does not appear on the Goldco website, the company is currently offering free silver with a precious metals IRA investment (the information below is from an email from a Goldco representative).

The bonus is paid only on the purchase of limited mintage coins.

You will receive additional free limited mintage silver coins. These are bullion coins produced by the mints of various countries in limited numbers.

They are usually ¼ ounce of gold or silver, and typically minted after 2020 (these are not the typical numismatic pre-1933 US minted gold and silver bullion coins).

The eligibility requirements are as follows:

- $50,000 to $100,000 investment – Receive 5% additional limited mintage silver coins.

- $100,000 or greater investment – Receive 10% limited mintage silver coins.

- For example, when you invest $50,000 you will receive $2,500 in additional coins and for a $100,000 investment you will receive $10,000 in additional coins.

Guarantees

All precious metals available for sale on Goldco come from national mints in the United States, United Kingdom, Canada, Australia, the Netherlands, New Zealand, and other countries.

Both bullion content and fineness are published for each metal offered, whether coin or bars.

Goldco offers their Goldco highest buy back guarantee, in which they’ll buy back your precious metals at the highest price.

Customer Experience

Goldco makes it easy to get in touch. You can call them at (858) 283-5842, Monday through Friday, from 7:00 AM to 4:00 PM Pacific Time.

You can also reach out by live chat or email—whichever works best for you.

When you contact Goldco, you’ll be connected with a precious metals specialist who can walk you through your options.

They’ll help you understand how to buy gold or silver and explain your secure storage choices.

In our experience, responses were fast and helpful. Whether by email or chat, the team was friendly and thorough—quickly answering questions with clear, useful information.

If you want to learn more before speaking with someone, Goldco’s website has an FAQ section and educational guides.

These cover the risks, rewards, and basics of investing in precious metals—ideal for retirees and first-time buyers.

Goldco also holds top ratings from the Better Business Bureau, Trustpilot, and other trusted review sites, showing a strong track record of customer satisfaction.

Storage & Security

Goldco does not store precious metals in-house. Instead, they work with trusted partners to make sure your gold and silver are kept safe, secure, and IRS-compliant.

Goldco has a preferred partnership with Equity Trust Company, a well-known provider of self-directed IRAs (SDIRAs). They also work with other major SDIRA custodians, so you have options.

Where your metals are stored

Your precious metals are stored in IRS-approved vaults through trusted depositories like:

- Delaware Depository

- Texas Depository

Both are fully insured and meet strict IRS standards, giving you peace of mind that your retirement assets are well protected.

Storage Options: Segregated vs. Non-Segregated

When metals are held inside a precious metals IRA, they must be stored with an approved trustee.

You can choose between:

- Segregated storage – Your coins and bars are kept separate from others.

- Non-segregated storage – Your items are stored together with similar metals from other customers.

Segregated storage usually costs more, but provides added separation of your physical assets.

Insurance coverage

While your metals are in storage, insurance is strongly recommended. The cost will vary depending on which insurance provider the trustee uses.

This helps protect the full value of your gold and silver.

Taking direct custody (outside of an IRA)

If you buy precious metals from Goldco outside of an IRA, you can have them shipped directly to you.

In this case, you may choose to insure your metals through your homeowner’s or renter’s insurance policy.

Account Setup and Maintenance

Opening a new account with Goldco is straightforward—Goldco makes the entire process of setting up, funding, and managing your investment simple and stress-free.

Setting up a precious metals IRA is a three-step process:

Step 1: Open an IRA account with Goldco, in which you will sign required documents and work with a company representative throughout the process. The account can be either a traditional or Roth IRA.

Step 2: Fund your account, which can also be accomplished by rolling over funds from other retirement accounts, such as an IRA, 401(k), 403(b), or TSP. (There are no taxes or penalties when you do a direct rollover of retirement assets from one plan to a Goldco IRA.)

Step 3: Purchase the precious metals you will hold in your new IRA.

If you are rolling over funds from another retirement account, the process will take approximately two weeks to complete.

Once you purchase precious metals for your Goldco IRA, delivery of the metals into your account will take between one and 12 weeks, depending on the availability of the specific metal purchased.

Request your free Gold IRA Kit today!

Reviews & Reputation

Goldco enjoys highly favorable ratings among various third-party sources:

- Better Business Bureau: A+, the highest rating given.

- Trustpilot: 4.8 out of five stars among nearly 1,500 reviews.

- Google listing: 4.9 out of five stars among more than 2,600 reviews.

Goldco stands out in the gold IRA industry for its strong reputation and consistently high customer ratings.

Goldco Alternatives & Competitors

Goldco can be an excellent choice as a source for precious metals. However, if you prefer to “shop the competition” consider the following alternatives:

|

Our Rating:

4.0

|

Our Rating:

4.2

|

Our Rating:

4.5

|

|

Minimum for IRA transfers:

$50,000

|

Minimum for IRA transfers:

$10,000

|

Minimum for IRA transfers:

$10,000

|

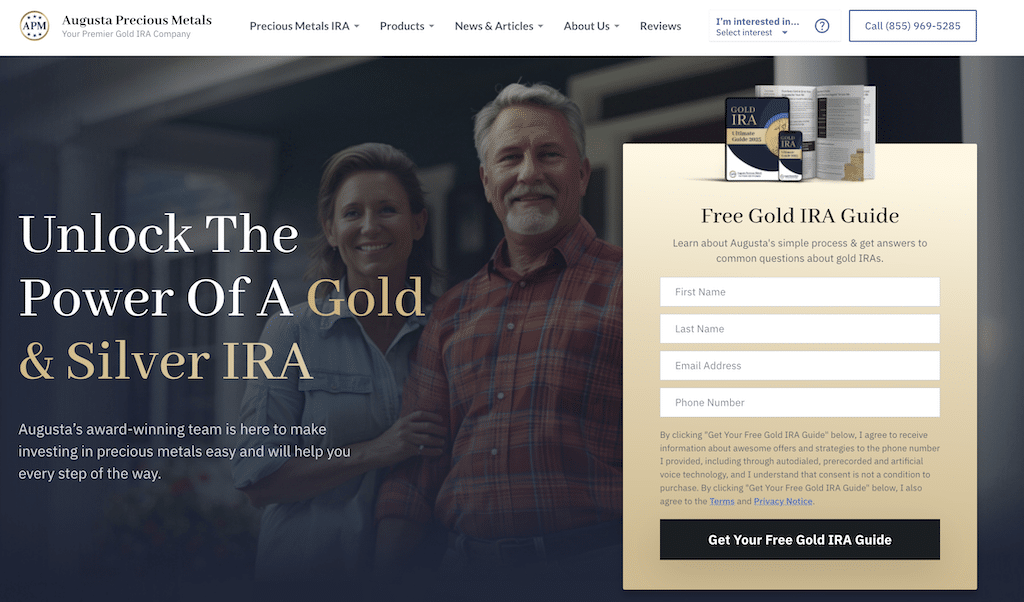

Augusta Precious Metals

Augusta Precious Metals is another precious metals dealer offering a gold IRA program. It offers precious metals similar to Goldco, as well as the ability to purchase metals outside of an IRA.

Request Augusta’s free gold guide

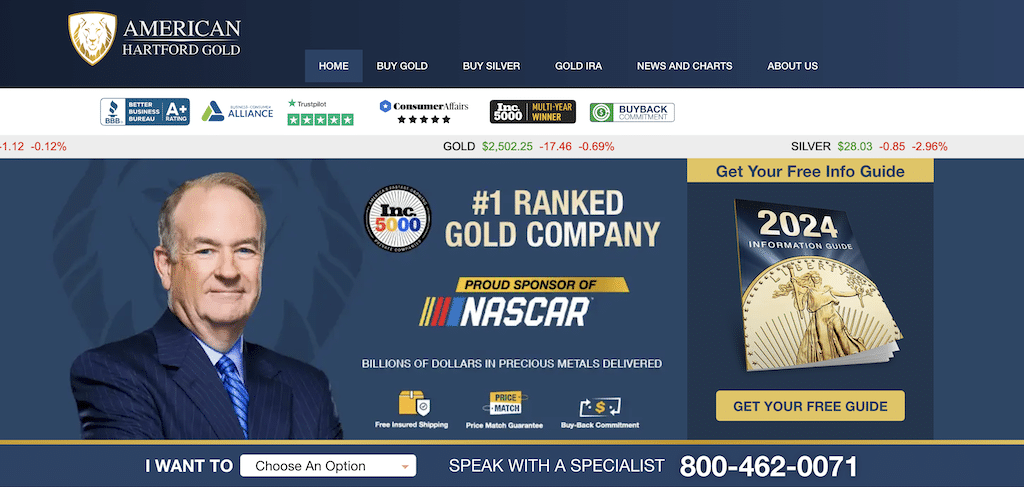

American Hartford Gold

American Hartford Gold also offers a gold IRA, as well as the direct purchase of silver and gold coins and bars.

American Hartford Gold offers a satisfaction guarantee that if you notify the company within seven days that you wish to cancel the transaction, you will receive a full refund within 30 days of receipt of the returned metals.

Request AHG’s free gold investors guide

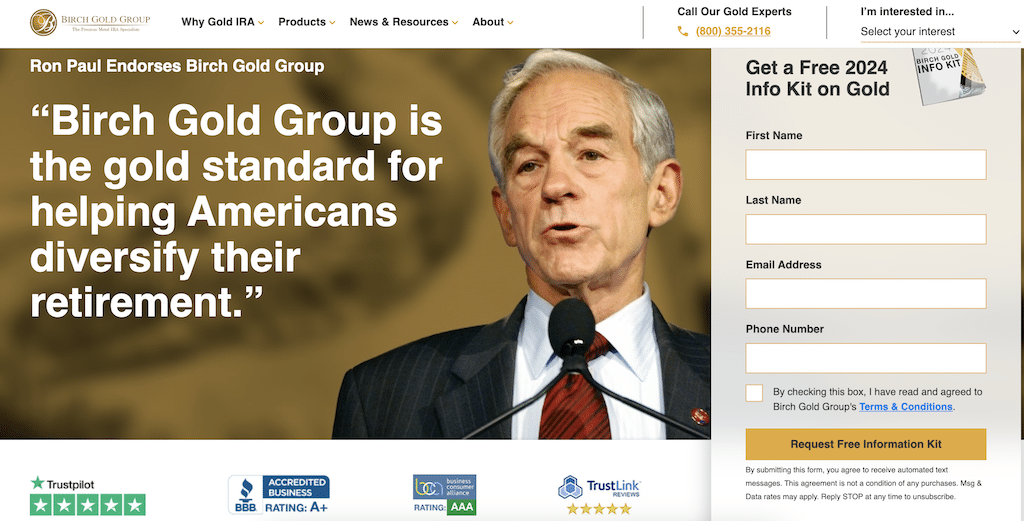

Birch Gold Group

Birch Gold Group also offers direct purchase of precious metals as well as a gold IRA. However, it offers a larger selection of gold and silver bullion coins than Goldco.

Request Birch’s free gold info kit

Is Goldco a legit company?

Based on the consumer ratings on Google, the Better Business Bureau, and Trustpilot – as well as the endorsements of various celebrities – Goldco appears to be a reputable and trustworthy company.

Request your free gold & silver guide today!

FAQs

Who owns Goldco?

Goldco appears to be a privately owned company, so no information on its ownership is provided.

However, Trevor Gerszt is the Founder/CEO of the company, and has been working as a gold dealer for over 20 years.

Does Goldco have any pending lawsuits or complaints?

Goldco has been the subject of two recent civil actions. Both actions involve filings over telephone related matters, and not disputes over business transactions with consumers.

How does Goldco make money?

Like most precious metals dealers, Goldco earns revenue on the markup between the price charged to customers for precious metals and the bullion price of the metal at the time of sale.

Related reading:

Goldco vs. Augusta Precious Metals

Goldco

Goldco is one of the premier Precious Metals IRA companies in the United States.

Product Brand: Goldco

4.7